The Relation of North Carolina's Tax Policy

to the Farmers of the State.

A Report of the Legislative Committee of the

North Carolina State Board of Agriculture.

Raleigh, N. C., Aug. 18, 1920.

To the Farmers of North Carolina:

The members of the North Carolina State Board of Agriculture consider themselves commissioned to look out for the interests of the North Carolina farmers. We know the farmers of North Carolina well enough, however, to know that all they want is truth and justice and honesty. The North Carolina farmer wants no special favors, no special privileges. He asks only that he be fed out of the same spoon as other citizens. As he opposes giving special privileges to other classes, so he asks none for himself.

These reflections are impressed upon us as we consider the questions that come to us from many North Carolina farmers asking for the exact facts as to North Carolina's taxation policy with regard to its fairness and with regard to its effect upon the State's agricultural interests. As members of the Legislative Committee of the North Carolina Board of Agriculture, the undersigned persons meeting in Raleigh and after earnest investigation of the facts, desire to submit their findings to their fellow farmers of the State. We present these facts we wish to say in the outset with no desire to favor any man or set of men, and with no desire to criticize any man or set of men. We are moved to speak only out of a desire to serve the cause of truth and to clarify a situation now much muddled through misconceptions and misunderstandings.

North Carolina's New Taxation Policy.

After prolonged study and investigation, the General Assembly of North Carolina in 1919 decided on a new taxation policy for the State. This policy, we are glad to say, was approved by the representatives of both political parties, and appeals to us still as distinctly a moral issue, which should be above political consideration. This new taxation policy as worked out by both political parties in 1919 aimed at three things:

(1). Honesty in assessments.

(2). A reduction in tax rate to correspond to the increase in assessed values.

(3). Provision for lightening the burdens of poverty and industry, and putting a larger share of the burdens of taxation on men with large incomes.

With regard to the latter point we may note in the outset that the last Legislature was the first one to take advantage of the authority given it by the Constitution to provide a $300 exemption for tax payers.

Now about the plans for securing just assessments. In the past everybody understood that he was permitted to list property for something less than its real value; and the result was that the more pliable a man's conscience, the lower the rate he named; and this thing has grown worse and worse year after year until it has amounted to a state disgrace. For a man to list his property at its real value meant that he would have to pay practically twice as much tax as he ought to pay. Such a system encouraged lying, and corrupted public morals at the fountain head. If the sworn officials of the State set the example of assessing real estate at 33-1/3 per cent, of its value, how could the state expect the individual tax payer to list his personal property at 100 per cent?

All this has been changed. Hereafter every property owner in the state is expected to list every cent's worth of property he owns — and list it at 100 per cent of its value; list it for what it would bring if offered for sale under favorable conditions.

Of course if this plan for revaluing property for taxation were offered without assurance that the tax rate would be correspondingly cut it would largely fail. The law specifically provides, however, that as assessed values increase, the tax rate must decrease, and the present General Assembly proposes to reduce the maximum constitutional rate on each $100 worth of property from 66-2/3 cents to 15 cents.

The Proposed Income Tax Amendment.

Now with regard to provision for throwing a larger part of the burden of taxation on those most able to bear it. The chief purpose of the revaluation policy is not to increase the amount of taxes, but to secure justice and equality in assessment. Then in order to provide larger revenues for the state and give us the necessary money for the many important tasks which advanced civilization places on the commonwealth - better schools, better roads, better health, better care of the unfortunate, etc. - the legislature submits to the people another important plan. At the election in November, the people will vote on a constitutional amendment authorizing the state to tax the income of the wealthy, without regard as to whether any particular income is derived from invested wealth or otherwise.

We hope every farmer will now make up his mind to vote for this amendment and urge others to do so. Heretofore we have had a shameful system in North Carolina. Incomes derived from labor have been taxable, while incomes derived from invested capital have been exempt from taxation, under constitutional provisions. Thus it is said that a famous tobacco manufacturer of this state had an income of a million dollars a year from his property, and was not required to pay one cent of income tax on it, while his stenographer or clerk getting $1,250 a year or more was required to pay an income tax. In England for years it has been the plan to put a heavier tax on "unearned incomes", that is to say on those derived from invested capital, than on "earned incomes", that is to say, on those derived from one's labor or profession. Our North Carolina plan has been on the other extreme, and the voters of the state ought to pile up 100,000 majority for changing it, just as they did for changing the constitution so as to provide a six-months school term.

A great part of the state's wealth is concentrated in the hands of a comparatively few wealthy persons, and it is only fair that they bear a larger share of the burdens of taxation. This is all the proposed income tax amendment means.

The Results of the New Tax Policy.

Such in brief was the state's new taxation policy as approved by representatives of both political parties in the General Assembly of 1919. What have been the results? We are profoundly convinced, after a careful study of the question that this new policy has worked out in a way to deserve the sympathy and support of the farmers of North Carolina. Of course, the plan has had its faults, its weaknesses, its imperfections. Of course, some mistakes have been made. Of course, we should try to remedy any weak places in the act. But on the whole we are convinced that the majority of the farmers of North Carolina feel as did one farmer speaking bluntly in the presence of some of the signers below since our committee met in Raleigh, when he said:

"The new tax act would be worth all the effort that has been put into it if it did nothing else except keep a hundred thousand North Carolinians from swearing to lies every tax-listing day. I thank God for an act which enables me to sign my tax-sheet with a clear conscience, knowing that I am compelled to tell the truth and that my neighbors are also".

We believe that the great majority of the farmers of North Carolina feel as this man did. They want to know first: "Is all property getting on the books at its fair value? Are the tax books telling the truth? Is each class of property honestly listed?"

If each class of property is honestly listed then it doesn't matter whether real estate or personal property or corporations show the greatest gain in values. As a matter of fact, however, we find that there is no reason whatever for charging that the new taxation policy will throw a largely increased burden on the farmer. Here are the facts:

The Valuation of Real Estate.

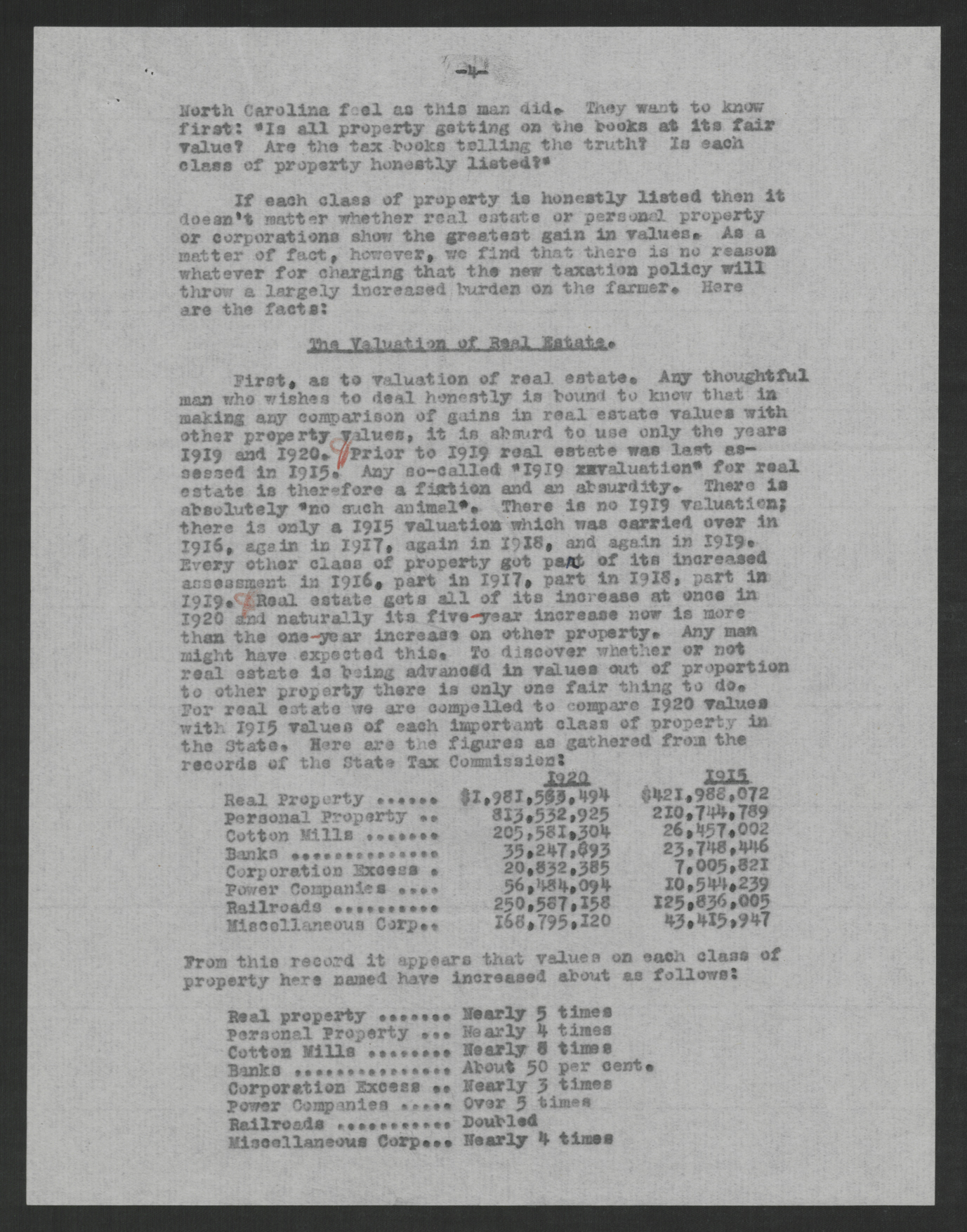

First, as to valuation of real estate. Any thoughtful man who wishes to deal honestly is bound to know that in making any comparison of gains in real estate values with other property values, it is absurd to use only the years 1919 and 1920.

Prior to 1919 real estate was last assessed in 1915. Any so-called "1919 valuation" for real estate is therefore a fiction and an absurdity. There is absolutely "no such animal". There is no 1919 valuation; there is only a 1915 valuation which was carried over in 1916, again in 1917, again in 1918, and again in 1919. Every other class of property got part of its increased assessment in 1916, part in 1917, part in 1918, part in 1919.

Real estate gets all of its increase at once in 1920 and naturally its five-year increase now is more than the one-year increase on other property. Any man might have expected this. To discover whether or not real estate is being advanced in values out of proportion to other property there is only one fair thing to do. For real estate we are compelled to compare 1920 values with 1915 values of each important class of property in the State. Here are the figures as gathered from the records of the State Tax Commission:

| 1920 | 1915 | |

| Real Property | $1,981,563,494 | $421,988,072 |

| Personal Property | 813,532,925 | 210,744,789 |

| Cotton Mills | 205,581,304 | 26,457,002 |

| Banks | 35,247,693 | 23,748,446 |

| Corporation Excess | 20,832,385 | 7,005,821 |

| Power Companies | 56,484,094 | 10,544,239 |

| Railroads | 250,587,158 | 125,836,005 |

| Miscellaneous Corp. | 168,795,120 | 43,415,947 |

From this record it appears that values on each class of property here named have increased about as follows:

| Real Property | Nearly 5 times |

| Personal Property | Nearly 4 times |

| Cotton Mills | Nearly 8 times |

| Banks | About 50 per cent. |

| Corporation Excess | Nearly 3 times |

| Power Companies | Over 5 times |

| Railroads | Doubled |

| Miscellaneous Corp. | Nearly 4 times |

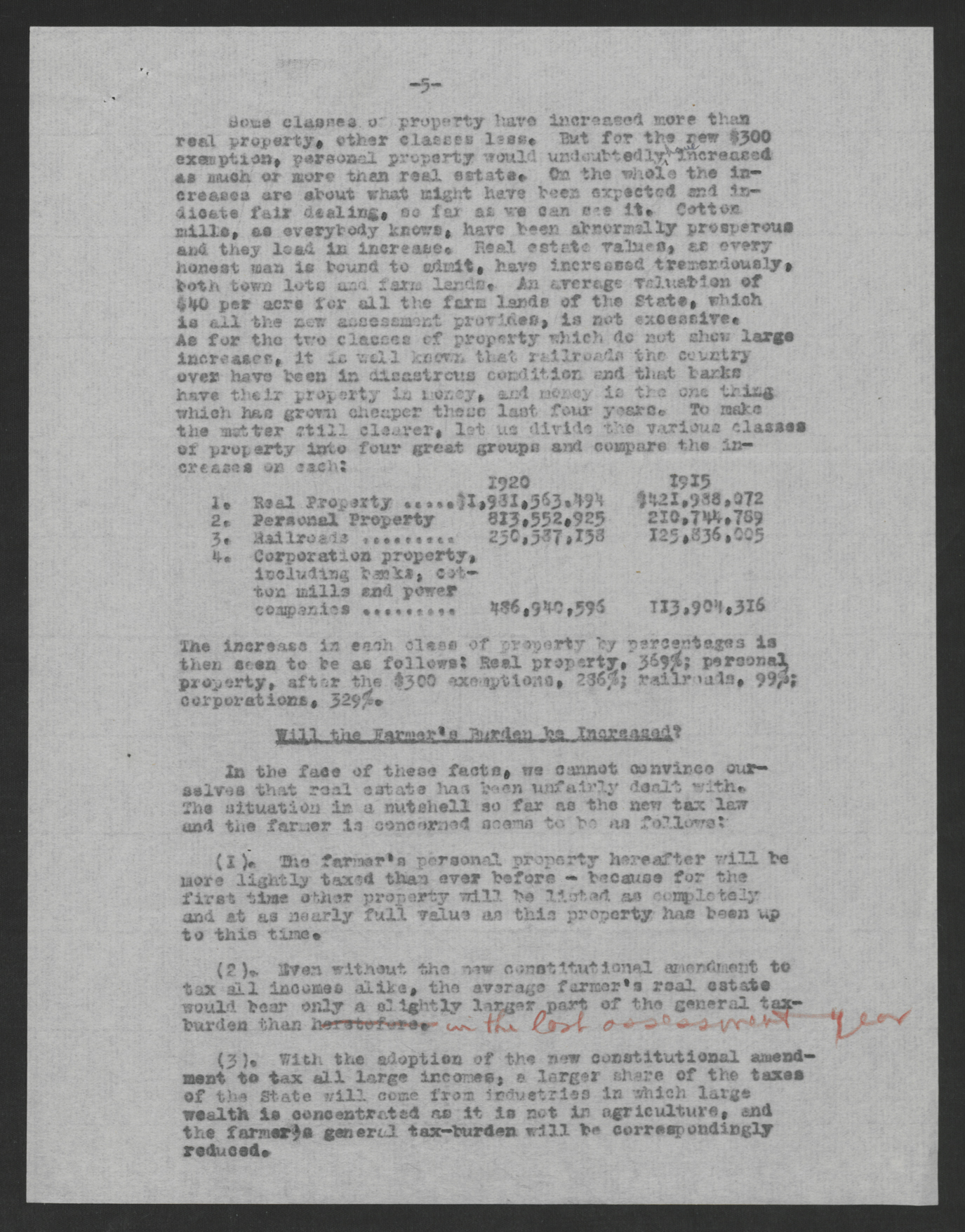

Some classes of property have increased more than real property, other classes less. But for the new $300 exemption, personal property would undoubtedly have increased as much or more than real estate. On the whole the increases are about what might have been expected and indicate fair dealing, so far as we can see it. Cotton mills, as everybody knows, have been abnormally prosperous and they lead in increase. Real estate values, as every honest man is bound to admit, have increased tremendously, both town lots and farm lands. An average valuation of $40 per acre for all the farm lands of the State, which is all the new assessment provides, is not excessive. As for the two classes of property which do not show large increases, it is well known that railroads the country over have been in disastrous condition and that banks have their property in money, and money is the one thing which has grown cheaper these last four years. To make the matter still clearer, let us divide the various classes of property into four great groups and compare the increases on each:

| 1920 | 1915 | ||

| 1. | Real Property | $1,981,563,494 | $421,988,072 |

| 2. | Personal Property | 813,552,925 | 210,744,789 |

| 3. | Railroads | 250,587,158 | 125,836,005 |

| 4. | Corporation Property, including banks, cotton mills and power companies | 486,940,596 | 113,904,316 |

The increase in each class of property by percentages is then seen to be as follows: Real property, 369%; personal property, after the $300 exemptions, 286%; railroads, 99%; corporations, 329%.

Will the Farmer's Burden be Increased?

In the face of these facts, we cannot convince ourselves that real estate has been unfairly dealt with. The situation in a nutshell so far as the new tax law and the farmer is concerned seems to be as follows:

(1). The farmer's personal property hereafter will be more lightly taxed than ever before - because for the first time other property will be listed as completely and at as nearly full value as this property has been up to this time.

(2). Even without the new constitutional amendment to tax all incomes alike, the average farmer's real estate would bear only a slightly larger part of the general tax-burden than in the last assessment year.

(3). With the adoption of the new constitutional amendment to tax all large incomes, a larger share of the taxes of the State will come from industries in which large wealth is concentrated as it is not in agriculture, and the farmer's general tax-burden will be correspondingly reduced.

The Taxation of Corporations.

Concerning the much-discussed matter of the taxation of corporations in North Carolina we find the following to be the facts: Every corporation is required to list for taxation under oath every item of property real or personal it owns, and to pay taxes on every such item of real or personal property in exactly the same way and to exactly the same degree and amount as if such property were owned by an individual citizen of the State. Then in addition to this, each such corporation is required to report to the State Tax Commission how much money it is making, how much dividends it is paying, etc. The State Tax Commission then estimates how much the corporation is worth as a going concern in excess of the property it owns and pays taxes on. The corporation is then required also to pay tax on a valuation which includes this estimated value on "good-will" or intangible property as well as on all its actual property. This explains the term "corporation excess". The theory of the State has been that the corporation itself thus pays taxes for all its shareholders and that they receive "dividends less taxes paid" and that to tax a corporation on its property and then tax each owner of stock for his share of the corporation's property would be like taxing a man on his land, and then taxing him on the deed to that land.

Such is a rather comprehensive review of the taxation situation in North Carolina as we find it. Our review is necessarily rather lengthy because we have wished to answer with both fairness and fullness the questions about which our farmers are asking for information.

Some Needed Amendments.

Our general conclusion is that the State is to be congratulated on having worked out for the first time a system of taxation scientific and honest in principle. We trust that we shall hold to that principle and change the system only by improving the details. Speaking only for ourselves in this as well as other matters mentioned we believe the following improvements should now be made:

1. Adequate provision should be made for revising any and all assessments which can be shown to be higher than the real value of the property on May 1, 1919.

2. A determined and thoroughgoing effort should be made to compel the listing of solvent credits and of all other forms of personal property. The farmer is willing to list all his property; he demands that all other property be listed.

3. In spite of efforts to equalize the situation for the farmer by allowing him to deduct his debts on January 1 from value of crops then on hand, we nevertheless believe it best to change the date for tax-listing back to May 1, or at least to April 1.

4. We renew the appeal, already sufficiently elaborated in this statement, for the ratification of the Income Tax Amendment at the coming November election.

Respectfully submitted,

R. W. Scott,

C. C. Wright,

I. N. Paine,

R. L. Woodard,

Clarence Poe,

W. A. Graham, Commissioner,

Legislative Committee.